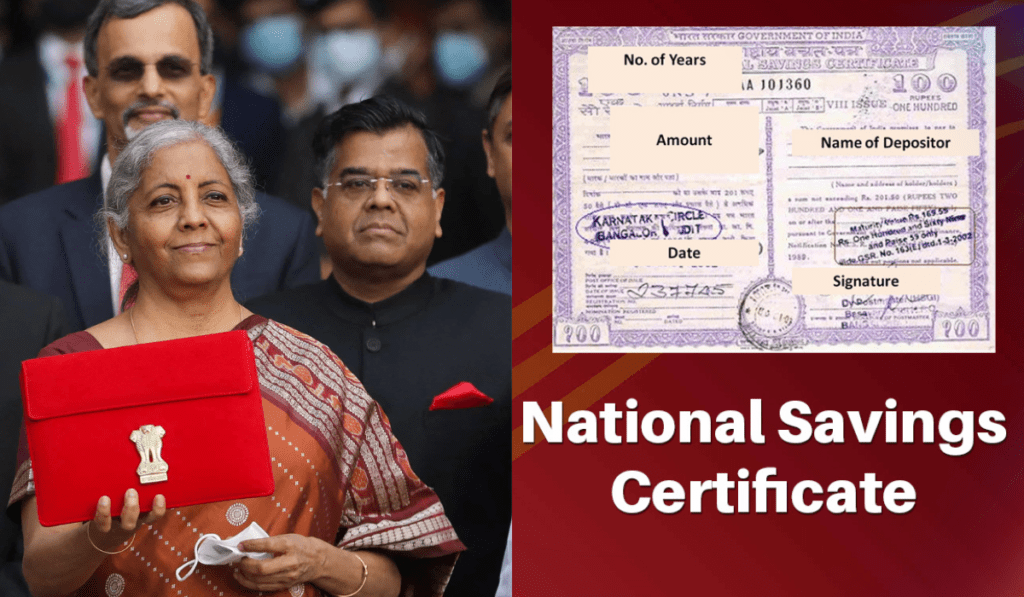

National Savings Certificates (NSCs) are like government-backed savings superheroes, encouraging everyday folks in India to save money wisely and enjoy tax benefits. Let’s dive into the key features that make NSCs stand out in the financial scene!

🌟 Who Can Grab NSCs? Adults (on their own or for a minor), trusts, two adults together, or even a minor – anyone can jump on the NSC bandwagon.

💼 Where to Get Them? Easy peasy! Head to any Post Office in India, and you can snag these certificates.

🏦 Extra Perk: Collateral for Loans Need a loan? Flash your NSCs, and banks might just grant your wish by accepting them as collateral.

⏰ How Long is the Commitment? NSCs are your financial buddies for a fixed five-year term. A short and sweet commitment!

💰 Tax Magic: Section 80C Here’s the jackpot – under Section 80C of the Income Tax Act of 1961, NSC holders get a golden ticket to tax benefits. That means more money in your pocket! 🎉

🔍 From Paper to Pixels: A Digital Revolution No more shuffling through physical certificates. Since April 2016, NSCs have hopped onto the digital train. Buy and redeem them online – convenient and futuristic!

📜 Back in Time: The NSC Origin Story Picture the 1950s – India just gained independence, and the government rolled out NSCs to fund nation-building. These certificates played a superhero role in those early days.

🤝 NSCs’ Buddies in Savings: PPF, FDs, and RDs NSCs aren’t lone rangers. They have cool companions like Public Provident Fund (PPF), Post Office Fixed Deposit, and Recurring Deposit. Different heroes, same mission – promoting savings and smart investments.

As the Finance Minister gears up for the Union Budget 2024, understanding the NSC language is like having a secret financial handshake. So, whether you’re an adult, a trust, or just someone keen on saving wisely, NSCs could be your ticket to financial superhero status! 🚀