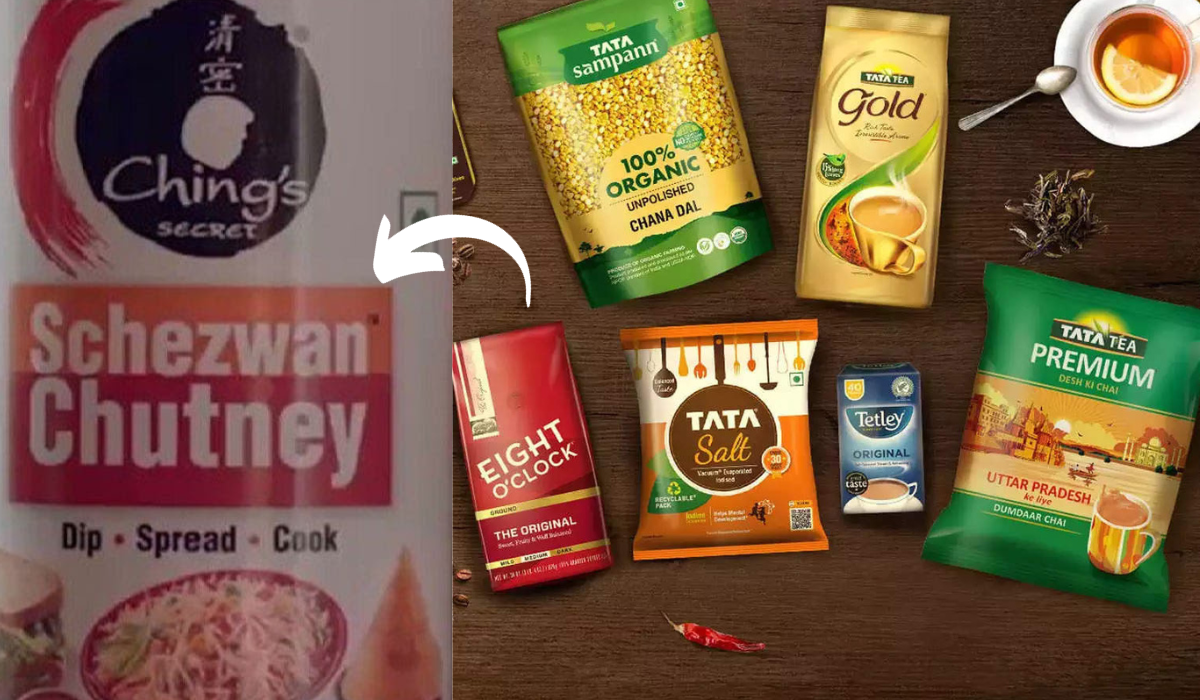

Tata Acquires Capital Foods: A Strategic Move into the Food Industry

In a recent business development, Tata Consumer Products Limited (TCPL), a prominent entity within the Tata Group, has successfully completed the acquisition of Capital Foods. This strategic move adds a new dimension to TCPL’s diverse portfolio, showcasing the group’s commitment to expansion through strategic acquisitions.

The Deal Details

The deal, valued at approximately ₹5100 crores, involves TCPL acquiring a 100% stake in Capital Foods, the company known for its popular brand – Ching’s Chinese Noodles. This acquisition signifies Tata’s entry into the instant noodle market, a move aligned with the evolving consumer preferences and market trends.

Product Portfolio

Capital Foods, operating under brands such as Ching’s Secret and Smith & Jones, offers a range of products including instant noodles, chili vinegar, ginger-garlic paste, pasta masala, peri-peri masala, soy sauce, and various other culinary delights. This diverse product line positions TCPL to tap into the growing demand for flavorful and convenient food options.

Expanding Horizons

Additionally, discussions are underway for a potential acquisition of Organic India by TCPL. If successful, this move could further enhance TCPL’s presence in the organic and herbal health care product segment. Talks suggest a valuation of ₹800 crores for Organic India, a company known for its extensive range of organic and ayurvedic health supplements, teas, staple and packaged foods.

Market Impact

Tata Consumer Products Limited has been on a notable trajectory in the stock market. With its market capitalization surpassing ₹1.08 lakh crores, the company’s shares have witnessed a remarkable surge. The share prices, which opened at ₹1125 on January 12th, reached a high of ₹1165 during the day, closing at ₹1154. This surge is part of a broader trend, with TCPL’s shares showing an impressive growth of over 48% in the past year.

Tata Consumer’s Rs 7,000-Crore Buyouts Set to Transform Product Portfolio.

• Tata Consumer Products acquires two homegrown brands in deals worth Rs 7,000 crore, aiming to boost revenue and expand product portfolio.

• Capital Foods brings “desi Chinese” cuisine to global… pic.twitter.com/3d0cRBRDQk

— nutshell news (@NutshellN28953) January 14, 2024

Conclusion

As Tata Consumer Products continues to make strategic moves, the acquisition of Capital Foods marks a significant entry into the instant noodle market. The potential acquisition of Organic India further reflects Tata’s commitment to diversification and catering to evolving consumer preferences. The coming months will reveal how these acquisitions shape TCPL’s market presence and influence its stock performance. Investors and industry enthusiasts will be keenly watching as Tata’s consumer business unfolds new chapters in its growth story.

2 COMMENTS